how to calculate net debt from cash flow

The following show two common ways to calculate CFADS. The net change in cash is calculated with the following formula.

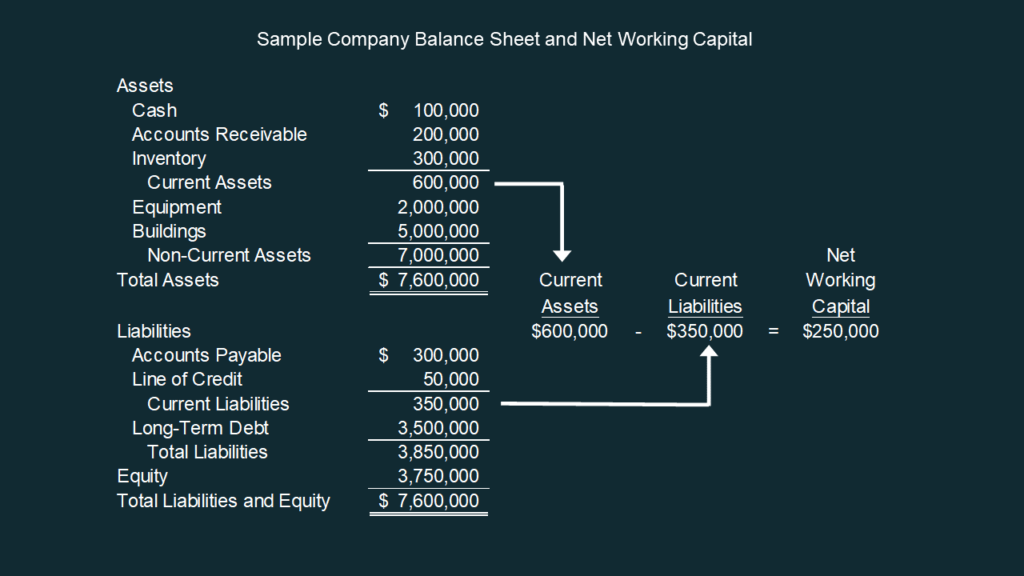

Net Working Capital Formulas Examples And How To Improve It

Put simply NCF is a businesss total cash inflow minus the total cash outflow over a particular period.

. Calculation of net cash flow can be done as follows. Calculation of the Equation. The LFCF formula is as follows.

This amount shows the outstanding debts the company would owe if all cash on hand was used to pay all debts owed. Starting with Receipts from Customers Subtract payments to suppliers and employees Subtract royalties. Operating cash flow Net income Non-cash expenses Increases in working capital Therefore and as shown in the chart below to calculate operating cash flow youd start with the net income from the bottom of your income statement.

Calculating a companys net change in cash is as simple as finding three sometimes four entries on a cash flow statement. Negative net cash flow can indicate to financial professionals that its time to make a decision that will impact the finances of the company in a positive way. Net Cash Flows 55000 23000 The Net Cash Flow will be Net Cash Flow 32000 Hence the requirement of the loan amount will be 80000 32000 which is 48000.

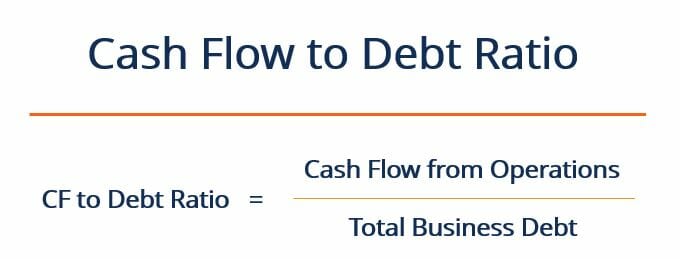

Calculate the companys cash flow to debt ratio as follows. So when a business generates cash flows some of the cash flow will need to be paid to the debt holder first in terms of financing cost interest expenses before the shareholders can receive any. Operating Cash Flow Net Income - Non-Cash Expenses Changes in Assets and Liabilities Working method of operating cash flow is as follows.

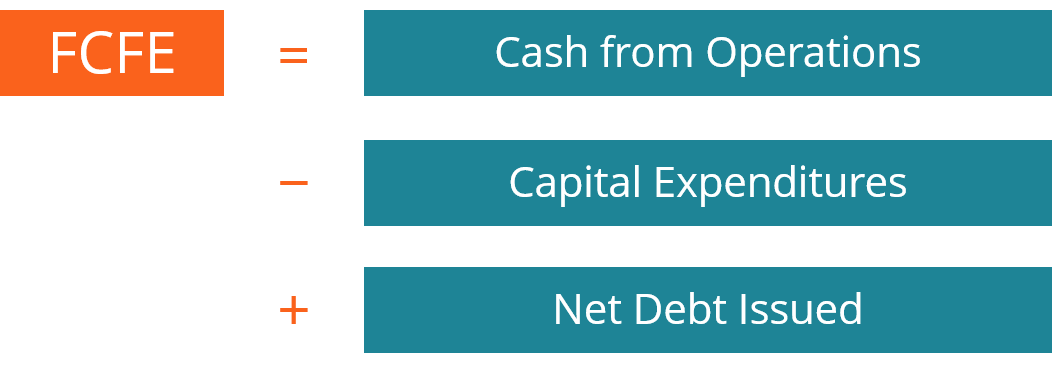

Cash flow to stockholders Dividends paid Net new equity. Simply put FCFF is the cash flow generated by the business as a whole owing to both shareholders and debtholders while FCFE is the cash flow. Let us take the example of a company DFR Ltd.

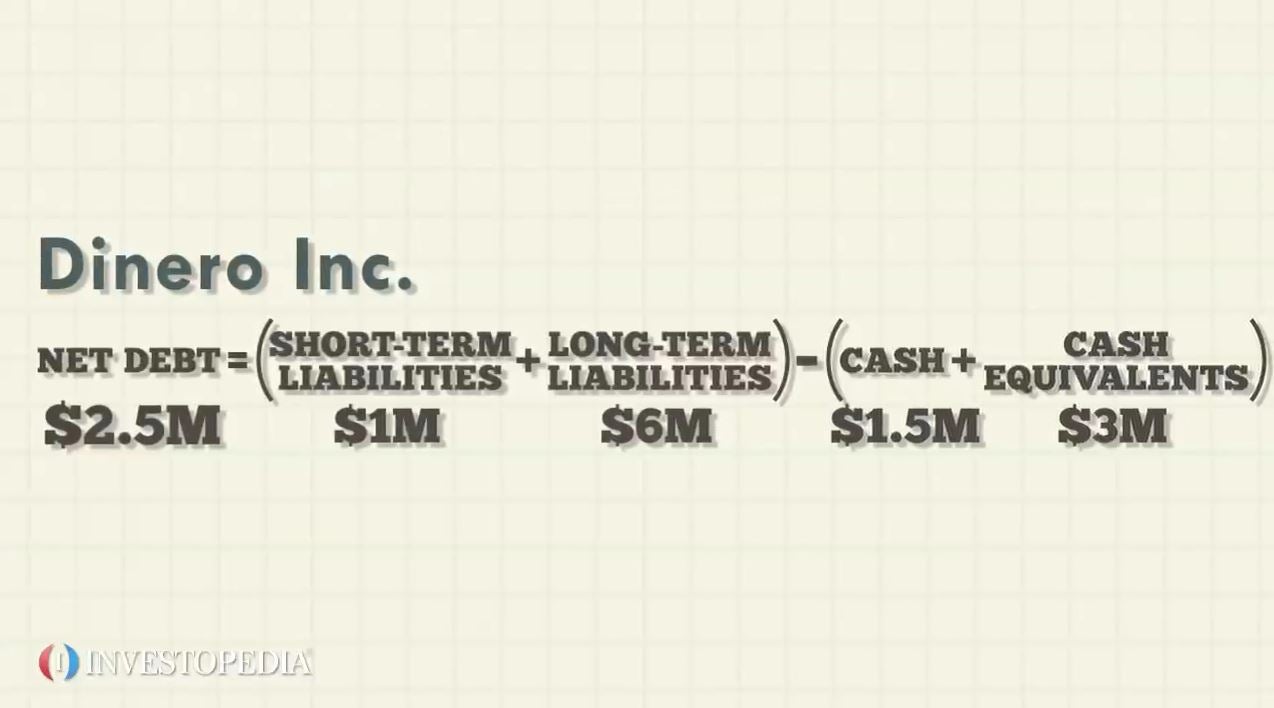

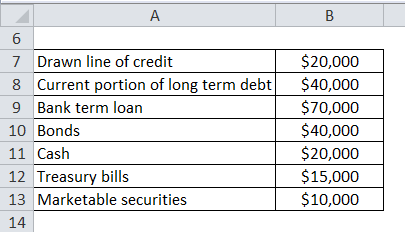

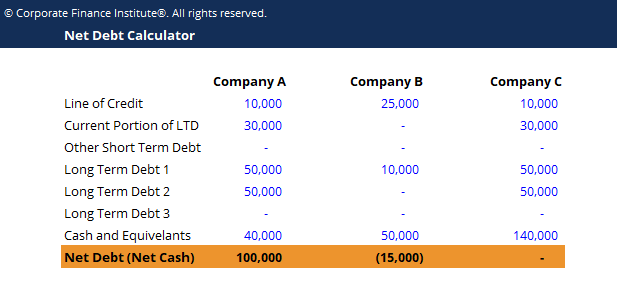

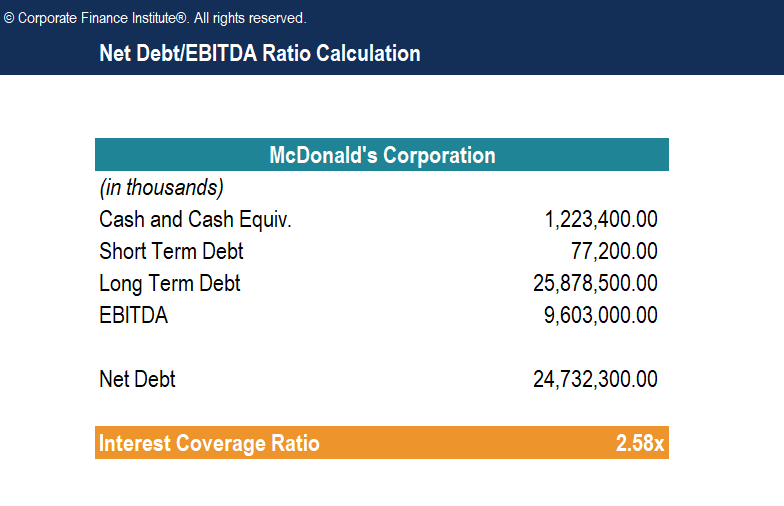

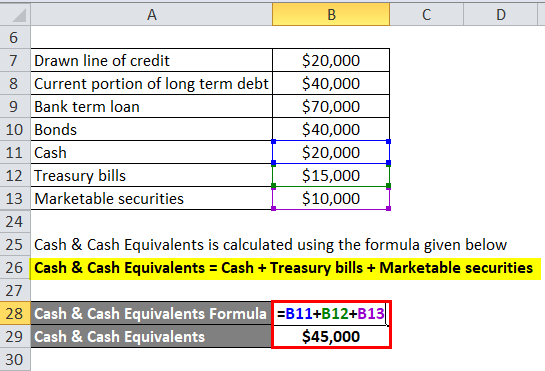

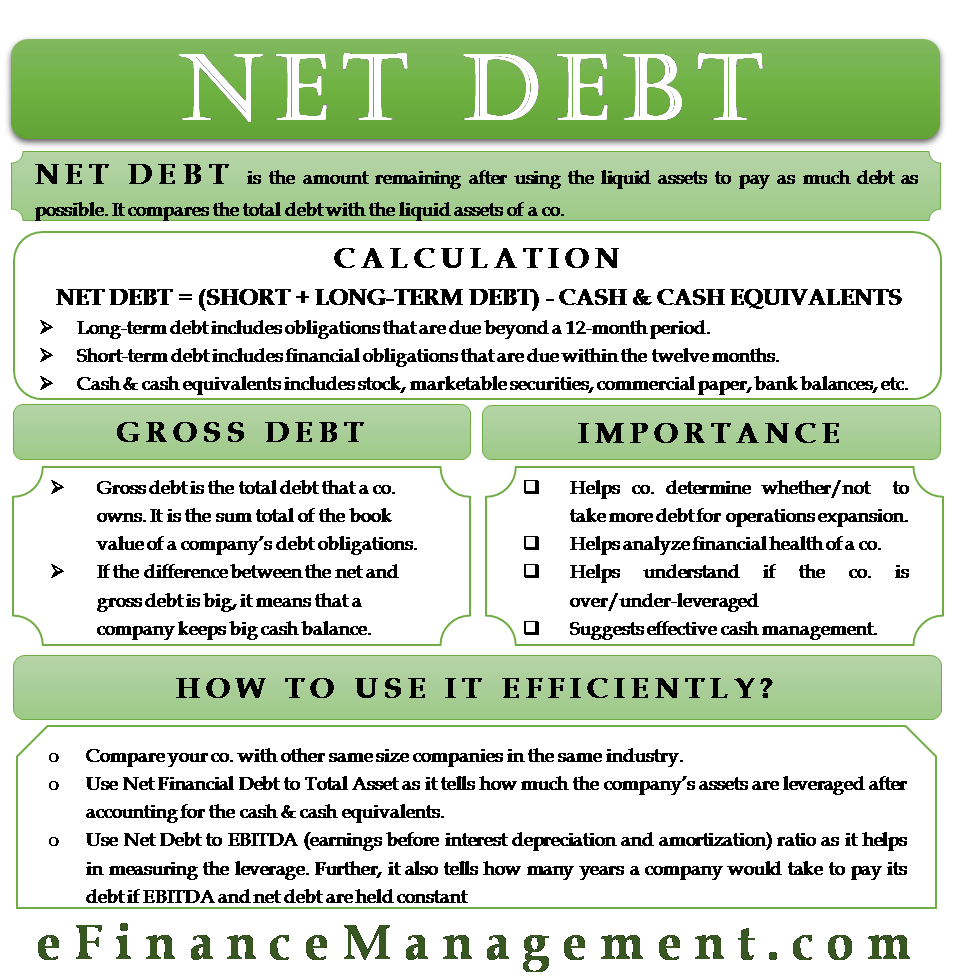

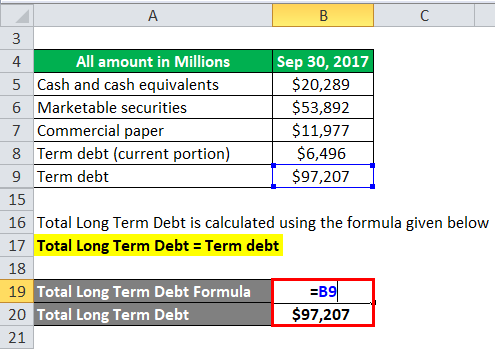

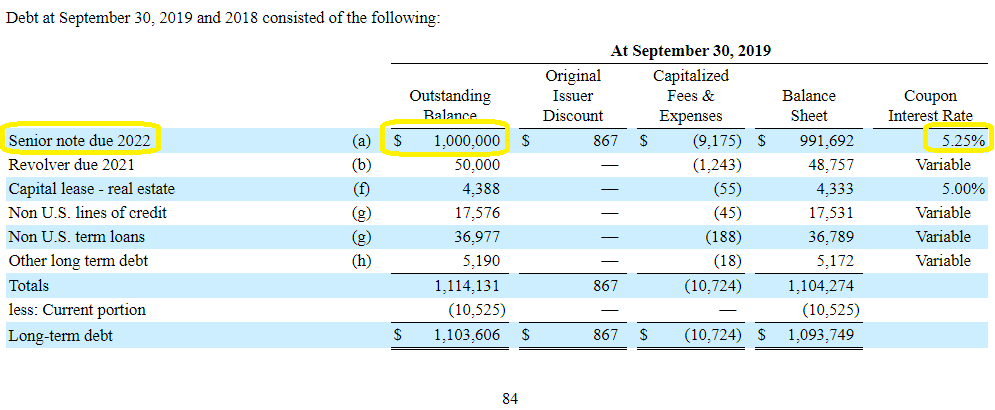

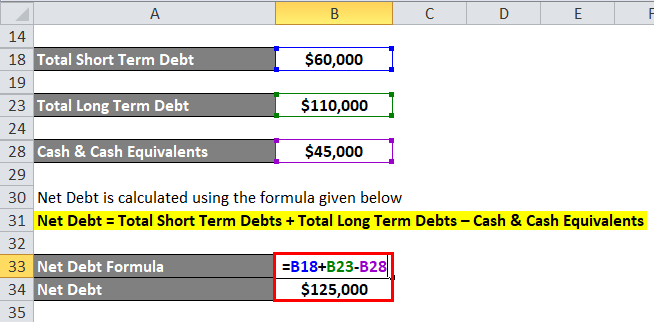

The senior management of the company wants to assess its cash flow during the year. Net Debt Short-Term Debt Long-Term Debt Cash and Cash Equivalents. Net cash flow from operating activities is calculated as the sum of net income adjustments for non-cash expenses and changes in working capital.

Giant Company wants to calculate its net cash flow. Net Annual Cash Flow Net Operating Income - Annual Mortgage Payments Net Annual Cash Flow 13460 - 12000 Net Annual Cash Flow 1460. Cash flow from operations.

The technical definition of the impairment loss is a decrease in net carrying value the acquisition cost minus depreciation of an asset that. Here are two examples of how companies calculate net cash flow. Abbreviated it looks like this.

Net cash flow year one cash inflow year one cash outflow year one. LFCF EBITDA - change in net working capital - CAPEX - mandatory debt payments. Start by calculating net cash flow for each year.

With the current figures in hand the accountants can also forecast the cash flow for a fixed period in the future. NCF total cash inflow - total cash outflow An extended formula is. Next you need to subtract dividends and expenses from each statements total cash flow figure.

Levered free cash flow earned income before interest taxes depreciation and amortization - change in net working capital - capital expenditures - mandatory debt payments. This amount is found by adding the total of all borrowings and subtracting cash on hand. Starting with EBITDA Adjust for changes in net working capital Subtract spending on capital expenditures Adjust for equity and debt funding Subtract taxes 2.

The net debt formula is calculated by subtracting all cash and cash equivalents from short-term and long-term liabilities. The finance department provided the following details about the cash flow during the year. Cash Flow Available for Debt Service CFADS Revenue Expenses - Net Working Capital Adjustments Capital Expenditures Cash Tax Other Items Where.

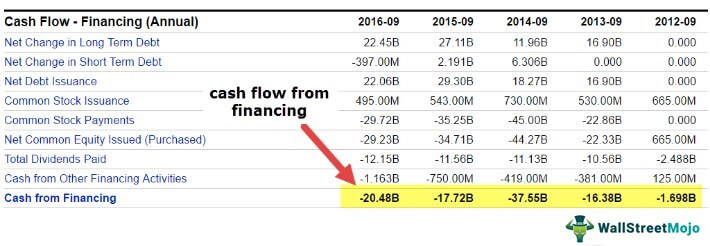

Cash Flow Available for Debt Service CFADS Formula Definition Revenue Revenue from operations other income Expenses Operations maintenance land lease other labor etc. Cash flow to creditors Interest paid Net new borrowing Cash flow to creditors 7900 3800 Cash flow to creditors 11700 c. First off you need to locate your companys cash flow statements from the previous two financial periods.

The cash flow to stockholders is the dividends paid minus any new equity. Net Borrowings on the Statement of Cash Flows Net borrowings is shown on the statement of cash flows under financing activities. Net Cash Flow is the difference between the cash coming into a business and the cash going out of a business during a specific period of time and this is the net cash flow from 3 different areas.

So the cash flow to stockholders is. Then find the figure for total cash flow on the statements. The formula for calculating operating cash flow is as follows.

Examples for how to calculate net cash flow. The cash involved in the operation of the business including cash coming in from sales of services andor products and cash going out from rent wages. Which is in the business of manufacturing furniture.

NCF Net cash flows from operating activities Net cash flows from investing activities Net cash flows from financial activities. What is the Net Cash Flow Formula. The net cash formula is as below Net Cash Cash Balance Current Liabilities You are free to use this image on your website templates etc Please provide us with an attribution link Where Cash Balance Cash Liquid Assets Examples of Net Cash Below are the examples of this concept to understand it in a better manner.

Net Cash Flow Formula Example 1. Begin aligned text Cash Flow to Debt frac 312500 1250000 25. How do I calculate accumulated cash flow.

Net Debt Formula And Excel Calculator

Net Debt To Ebitda Ratio Guide Formula Examples Of Debt Ebitda

Net Debt Formula Calculator With Excel Template

Net Debt What It Is How To Calculate It And What It Tells

Cash Flow To Debt Ratio Meaning Importance Calculation

Net Debt Formula Calculator With Excel Template

Free Cash Flow To Equity Fcfe Learn How To Calculate Fcfe

Net Cash Flow Formula Calculator Examples With Excel Template

Net Debt Formula Calculator With Excel Template

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

Net Debt Formula And Excel Calculator

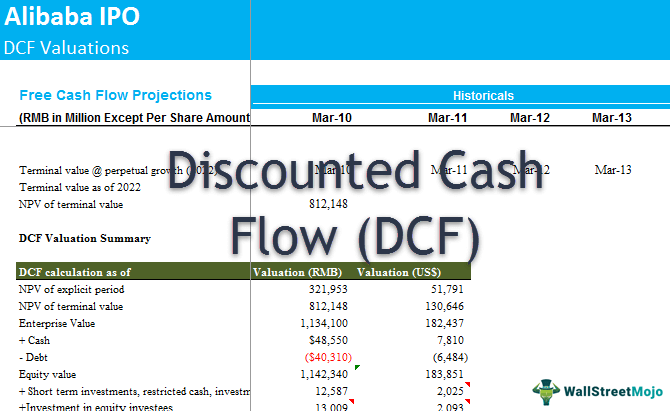

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data

Cash Flow From Financing Activities Formula Calculations

Net Debt Formula Calculator With Excel Template

Net Debt Formula And Excel Calculator